Weighted Average and Portfolio Return

Weighted Average

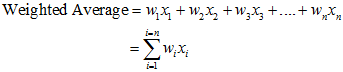

Some points are more important than others. And, some results contributed more than others to the final result. For example, final exam usually contributes more than the initial assignments. For example, in a particular module an assignment contributes 30%, and final exam 70% to the final result. Weighted average is an average where different quantities have different weight. And, it is calculated using the formula

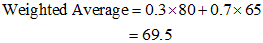

Now, if in the above example where assignment contributes 30%, and final exam 70% to the final result, a student obtained 80% marks in assignment and 65% in the final exam, then his final result is the weighted average i.e.

So, the student obtained 69.5% marks in the module.

Portfolio

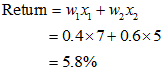

An investor usually invests in different assets. And, the combination of the assets hold by an investor is called portfolio. Consider an investor who invested in two different stocks A and B. He invested 40% in stock A and 60% in the stock B and obtained 7% return from stock A and 5% from stock B. So, his total return on the investment is the weighted average, i.e.

|

Basic Financial terms in Corporate and Mathematical Finance |

Selection of assets, risk and return, and portfolio analysis |

View the online notes for Financial Mathematics (CT1) |

Learn Financial Computing with C++ step by step |