Square-Root Asian Option Formula Derivation

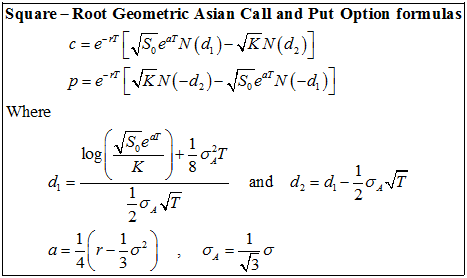

Here, we will derive formulas for European style square-root Asian call and put options when we are taking geometric average of the underlying's price.

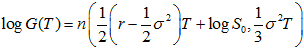

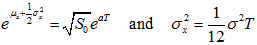

As we know that the expectation and variance of geometric average is

Where n(a,b) represents a normal distribution with mean a and variance b. So, in case of Geometric Square-Root Asian option, we have

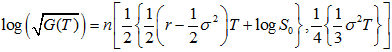

Where

and

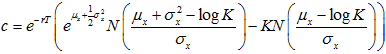

Now, we need to put these two values in Black's formula (generalized version)

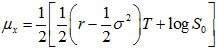

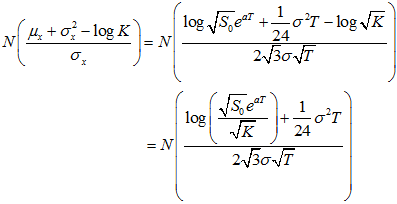

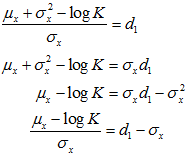

First take

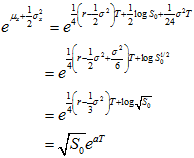

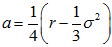

Where

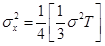

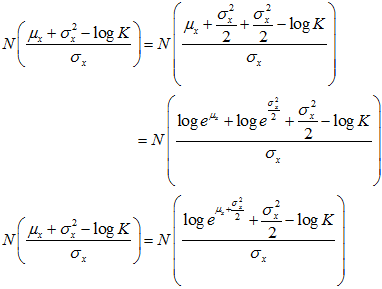

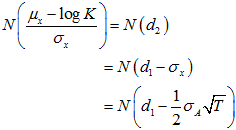

Now, consider

Using

we have

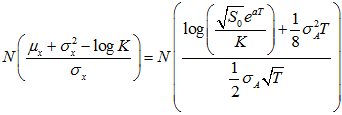

Setting

we have

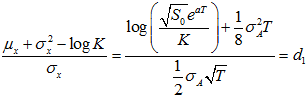

For simplicity, we set

So, now

Hence,

Now, by putting all values in Black's formula, we obtain the pricing formula for our geometric square-root Asian option.

|

Basic Financial terms in Corporate and Mathematical Finance |

Selection of assets, risk and return, and portfolio analysis |

View the online notes for Financial Mathematics (CT1) |

Learn Financial Computing with C++ step by step |