|

> Financial Mathematics |

Present and Future Values

A famous quote in Economics and Finance is, "A dollar today is worth more than a dollar tomorrow".

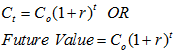

As we know that, the compound interest formula is

Where P is the initial cash and A is cash at time t.

For simplicity, let

P = Co (Initial cash or cash at t = 0, which is called "Present Value")

A = Ct (cash at time t, which is called "Futute Value")

So, the compound interest formula becomes

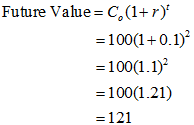

For example, if the prevailing interest rate is 10%. The future value of cash $100 after 2 years will be

So the future value or C2 (Value after 2 years) 0f $100 is $121 if the interest rate is 10%. In other words, it tells us that if the interest rate 10%, then $100 today is equivalent to $121 after 2 years.

Present Value

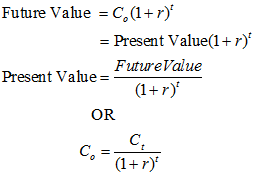

Rearrange the future value formula to obtain the formula for Present Value

For example, after 2 years the value of cash will be $121. If the prevailing interest rate is 10%, the value of the cash today is

So the present value or Co (Value when t = 0) 0f $121 is $100 if the interest rate is 10%. In other words, it tells us that if the interest rate 10%, then $121 after 2 years are equivalent to $100 today.

Example 1.

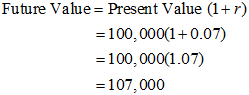

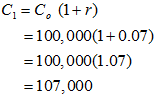

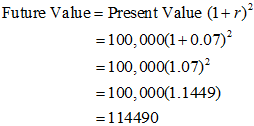

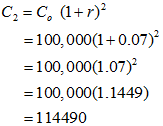

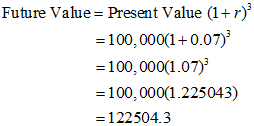

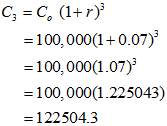

Today the price of a particular flat in Brighton, UK is $100,000. And the interest rate is 7%. The owner wants to sell his flat after a few years. What will be the future values of the flat after one, two and three years, if the interest rate remains the same for the next year?

Solution:

(a) Future value after 1 year | Alternate Method: |

(b) Future value after 2 years | Alternate Method: |

(c) Future value after 3 years | Alternate Method: |

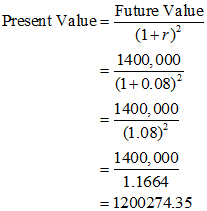

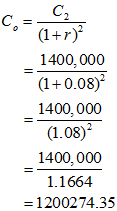

Example 2.

A buyer agree to purchase a flat for $1400,000 after two years. The flat owner wants to sell his flat now. What is the present value of the flat, if the annual interest rate is 8%?

Solution:

Present Value Calculations: | Alternate Method: |